The era of “wild west” e-commerce entry into the United States has officially drawn to a close. Following the elimination of the Section 321 de minimis exemption for postal shipments in August 2025, U.S. Customs and Border Protection (CBP) has moved to the next phase of enforcement and facilitation.

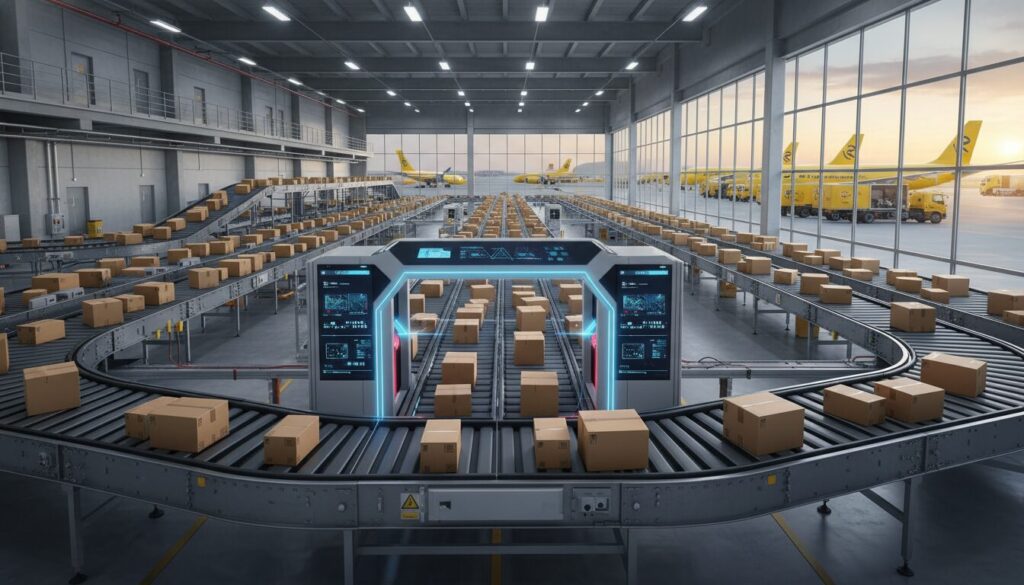

In a critical move to prevent supply chain paralysis, DHL, others land US CBP approval to handle postal duties, marking a pivotal shift in how global brands access the American consumer.

As of early 2026, the logistics landscape faces a hard deadline. With the expiration of temporary flat-fee options on February 28, shippers must now utilize approved third-party remitters to handle full duty payments. This article analyzes the strategic implications of CBP’s authorization of DHL Global Forwarding, Seko Logistics, and GHY eBiz, and what it means for the future of cross-border trade.

Why It Matters: The Compliance Cliff

For decades, the de minimis threshold allowed shipments under $800 to enter the U.S. duty-free with minimal data requirements. This fueled the explosive growth of direct-to-consumer (DTC) giants like Shein and Temu. However, the August 2025 regulatory shift dismantled this exemption for postal shipments, creating an immediate “compliance cliff.”

The impact was instantaneous and severe. According to recent data, postal de minimis volume plummeted from 264.1 million shipments in 2020 to just 68.6 million in 2025.

The February 28 Deadline

The logistics industry is currently navigating a transition period that ends abruptly on February 28. Until now, certain flat-fee options (ranging from $80 to $200 per shipment depending on classification) provided a temporary buffer for informal entries.

When these options expire, shippers without a robust duty remittance strategy face two outcomes:

- Cargo Stagnation: Goods held at International Mail Facilities (IMFs) due to unpaid duties.

- Margin Erosion: Unexpected brokerage fees and full duty rates applied retroactively.

The authorization of 39 qualified third-party remitters—now including heavyweights like DHL and Seko—is CBP’s answer to keeping trade flowing while enforcing tax collection.

See also: Aritzia Case Study: Tariffs & De Minimis End

Global Trend: The End of Frictionless Cross-Border Trade

The U.S. move mirrors a broader global trend toward digital borders and fiscal enforcement. The days of shipping globally with a “label and pray” strategy are over.

United States: Enforcement First

The U.S. has transitioned from a facilitation-first model to an enforcement-first model. The inclusion of major logistics integrators as duty remitters signals that CBP expects carriers to police their own networks. The responsibility for accurate HTS (Harmonized Tariff Schedule) classification has effectively shifted upstream to the logistics provider and the merchant.

Europe: The Precursor (iOSS)

The European Union set the precedent for this shift in 2021 with the removal of the €22 VAT exemption and the introduction of the Import One-Stop Shop (iOSS). The U.S. adoption of authorized remitters is functionally similar to the EU model, where the marketplace or logistics provider collects levies at the point of sale (DDP – Delivered Duty Paid).

China & Asia: Strategic Pivots

For Asian manufacturers, the loss of the U.S. postal loophole forces a change in logistics architecture. We are observing a shift away from direct postal injection toward:

- Bonded Warehousing: Storing goods within U.S. Foreign Trade Zones (FTZs).

- Nearshoring: Moving final assembly to Mexico to leverage USMCA benefits, though this strategy comes with its own volatility.

See also: Borderlands Mexico: Shipping Strategy Innovation Case Study

Case Study: DHL, Seko, and GHY eBiz Bridge the Gap

The core innovation here is not the movement of goods, but the movement of data and money. By authorizing DHL Global Forwarding, DHL eCommerce, Seko Logistics, and GHY eBiz, CBP has effectively deputized these private entities to manage the fiscal complexity of millions of parcels.

The Challenge: The Postal Disconnect

Historically, the Universal Postal Union (UPU) network was designed for letters, not commercial trade. Foreign postal operators (like China Post or Royal Mail) generally lack the infrastructure to calculate and remit complex U.S. duties before the package leaves the origin country.

The Solution: The “Authorized Remitter” Model

DHL and Seko have stepped in to act as the digital and financial bridge.

How It Works

- Data Ingestion: The merchant sends SKU-level data (price, HS code) to the logistics provider (e.g., DHL eCommerce) at the moment of checkout.

- Duty Calculation: The provider calculates the exact duty owed based on the new post-August 2025 rules.

- Collection: The consumer pays the duty at checkout (DDP).

- Remittance: DHL/Seko aggregates these payments and remits them directly to CBP via the authorized channel, bypassing the manual collection process at the IMF.

Comparative Analysis: Old vs. New Model

The table below illustrates the operational shift for a typical e-commerce shipment from Asia to the U.S.

| Feature | Pre-August 2025 (De Minimis) | Post-Feb 2026 (Authorized Remitter) |

|---|---|---|

| Duty Threshold | Free under $800 | Duties apply from $0.01 |

| Clearance Speed | Instant (Manifest Release) | Fast (Pre-cleared via Remitter) |

| Cost to Merchant | Shipping only | Shipping + Duty + Processing Fee |

| Data Requirement | Basic Description | Full 10-digit HS Code |

| Risk | Low inspection rate | High compliance scrutiny |

| Key Partners | National Posts (USPS) | DHL, Seko, GHY eBiz |

Why This is a “Win” for Logistics Leaders

For strategy executives, the inclusion of GHY eBiz alongside giants like DHL is notable. GHY specializes in trade compliance and acts as a pure-play compliance partner. This allows shippers who use multiple carriers to centralize their duty payments through a single “control tower,” ensuring consistency across their supply chain regardless of which physical carrier moves the box.

Key Takeaways for Industry Leaders

The authorization of these providers is a signal to the market: Compliance is now a competitive advantage, not just a legal requirement.

- Adopt DDP (Delivered Duty Paid) Immediately: With the end of flat fees, sending goods DDU (Delivered Duty Unpaid) will result in customer refusals at the door. Utilizing authorized remitters like DHL or Seko to enable DDP is mandatory for customer experience.

- Data Hygiene is Critical: The new model fails without accurate data. If your HS codes are incorrect, the authorized remitter cannot process the payment, and the shipment will stall. Investing in AI-driven classification tools is now a capital priority.

- Diversify Carrier Mix: While DHL and Seko are approved, capacity will be tight as millions of shipments migrate from the postal network to commercial clearance channels. Shippers should engage with multiple approved remitters to secure volume capacity.

- Re-evaluate Margins: The “free ride” of the postal network is gone. Cost models must be updated to include duty and brokerage fees. For low-margin items, this may necessitate price increases or sourcing shifts.

Future Outlook

The authorization of DHL, Seko, and others is likely just the beginning. As the volume of duty-liable parcels stabilizes, we expect CBP to expand the list of 39 qualified remitters, potentially inviting technology platforms and marketplaces to participate directly.

Furthermore, we anticipate a secondary trend of “Virtual Aggregation.” Smaller logistics players who cannot achieve CBP authorization will likely partner with firms like GHY eBiz to offer white-labeled duty remittance services.

The Bottom Line: The regulatory walls are closing in, but the gates are opening for those who partner correctly. The authorization of DHL and Seko provides a clear, compliant path forward for global brands willing to adapt to the new reality of taxed cross-border trade. Shippers who ignore the February 28 deadline do so at the peril of their supply chains.