The era of “volume is vanity, profit is sanity” has arrived with a vengeance in the global logistics sector. For the past decade, the industry operated on a premise of endless e-commerce expansion, where capacity was king and market share justified any cost. That era ended abruptly in early 2025.

The recent announcements from Amazon and UPS—cutting a combined 60,000 jobs—mark the beginning of the “Great De-coupling.” This is not merely a recessionary tightening; it is a structural transformation driven by Artificial Intelligence (AI) and a ruthless pivot toward margin optimization.

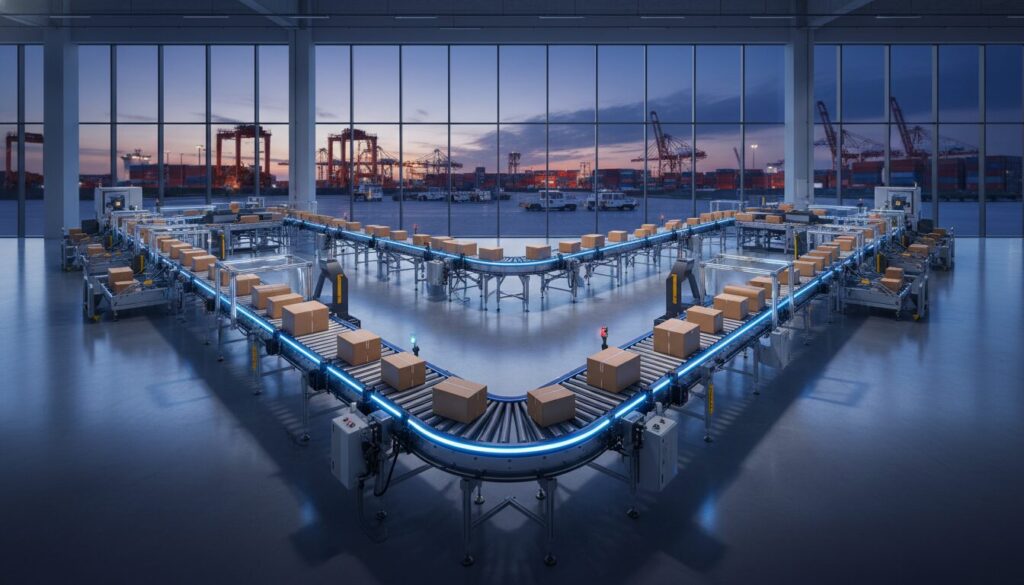

For logistics leaders in the US, Europe, and Asia, this shift signals that the traditional 3PL model is obsolete. To survive, organizations must look to a new model of operation: The Singapore Supply Chain Blueprint. This approach prioritizes “Value Density” over “Package Density,” transforming logistics hubs from simple transit points into data-driven orchestration centers.

Why It Matters: The End of the Volume Era

The simultaneous restructuring of the world’s largest e-retailer and the world’s largest parcel carrier is a bellwether event.

Amazon is eliminating 30,000 corporate roles, specifically targeting middle management. The driver? “Project Dawn,” an internal initiative utilizing Generative AI to automate complex tasks such as demand forecasting, vendor negotiation, and inventory placement—roles previously held by humans.

UPS, conversely, is cutting 30,000 jobs by 2026 as part of an “Amazon accelerated glide-down.” UPS is actively firing its biggest customer (low-margin Amazon e-commerce volume) to pivot aggressively toward high-yield sectors like healthcare, biologics, and intricate B2B logistics.

The Strategic Implication

This “Great De-coupling” creates a vacuum in the market. As major players exit the low-margin volume game or automate the intelligence required to manage it, mid-sized 3PLs and regional carriers are left with a choice: fight for the scraps of commoditized delivery, or evolve into high-value orchestration partners.

As discussed in our analysis of the Nike Logistics Shift, this trend of consolidation and automation is not isolated to carriers; shippers are also streamlining, demanding that their logistics partners provide more than just transport—they demand intelligence.

Global Trend: The Shift from Package Density to Value Density

The “Great De-coupling” is playing out differently across major economic zones, but the underlying theme is identical: the pursuit of higher margins through technology and specialization.

United States: The AI “Middle Man”

In the US, the trend is defined by the removal of human latency. Amazon’s strategy reveals that the “middle man” in logistics is no longer a broker or a manager—it is an algorithm. The goal is to reduce the “cost to serve” per unit not by driving trucks faster, but by predicting demand so accurately that inventory moves fewer miles.

Europe: Sustainability as a Margin Driver

In Europe, the de-coupling is intertwined with the Green Deal. Companies like DHL and Maersk are shedding low-margin contracts that do not fit their sustainability goals. High-value logistics now implies “low-carbon logistics,” where premium pricing is attached to verified green supply chains.

Asia: The Rise of the Orchestrator

In Asia, particularly within the China-ASEAN corridor, the focus is on integrating fragmented networks. With players like SF Holding and J&T Express consolidating power (see: J&T Express & SF Holding: Reshaping Global Logistics), the region is moving away from pure manufacturing export to complex supply chain management.

The following table contrasts the “Old Guard” strategy with the “New Normal” triggered by Amazon and UPS:

| Feature | The Volume Era (2010-2023) | The Value Era (2025+) |

|---|---|---|

| Primary Metric | Package Density (Volume/Route) | Value Density (Margin/Cubic Meter) |

| Technology | WMS/TMS for Execution | GenAI for Prediction & Negotiation |

| Labor Strategy | Scale workforce with volume | Decouple revenue from headcount |

| Amazon’s Role | The “Everything Store” Builder | The Automated Logistics Brain |

| UPS’s Role | The E-commerce Backbone | The Healthcare/B2B Specialist |

Case Study: The Singapore Supply Chain Blueprint

If Amazon represents the “Digital Brain” and UPS represents the “Specialized Hand,” Singapore represents the “Central Nervous System.”

Singapore has long been a transshipment hub, but its recent evolution offers a blueprint for how logistics companies worldwide should respond to the Amazon-UPS de-coupling. The “Singapore Blueprint” is not about geography; it is a methodology of becoming a Trusted Trade-Tech Orchestrator.

The Anatomy of the Blueprint

Singapore realized early that it could not compete on land or cheap labor. Instead, it positioned itself as the control tower for high-value flows—exactly the pivot UPS is attempting now.

1. High-Value Specialization (The UPS Alignment)

Singapore’s Changi Airport Group and SATS aggressively pursued IATA CEIV Pharma certifications years ahead of the curve. Today, Singapore handles a disproportionate amount of the world’s high-value biomedical and aerospace cargo.

- The Lesson: While UPS exits general e-commerce to focus on healthcare, Singapore had already built the infrastructure (cool ports, secure zones) to facilitate it. 3PLs must identify their “healthcare equivalent”—a niche requiring high trust and certification that prevents commoditization.

2. Digital Orchestration (The Amazon Alignment)

Singapore’s TradeTrust initiative and the Networked Trade Platform (NTP) utilize blockchain and open APIs to digitize trade documents across borders.

- The Lesson: Amazon is using AI to automate vendor management. Singapore is using digital public infrastructure to automate compliance. Logistics providers must stop selling “warehousing” and start selling “digital compliance and visibility.”

3. Real-World Application: DB Schenker’s Red Lion

A prime example of this blueprint in action is DB Schenker’s “Red Lion” facility in Singapore. Costing €101 million, it is the largest investment in the company’s history globally.

- Orchestration: It integrates air freight and contract logistics under one roof (free trade zone).

- Automation: It features next-generation automation that reduces lead times by 40%, mirroring Amazon’s efficiency goals.

- Value Density: It is specifically designed for the semiconductor and healthcare industries—high value, low tolerance for error.

By consolidating high-tech automation with high-value sector focus, DB Schenker in Singapore is immune to the “commoditization trap” that forced UPS to restructure.

Key Takeaways for Logistics Executives

The Amazon-UPS de-coupling is a warning: being a generic “mover of boxes” is a race to the bottom that you will lose to automation or consolidation.

1. Automate the “Middle” or Be Eliminated

Amazon’s “Project Dawn” proves that demand forecasting and vendor management are now AI domains.

- Action: Stop relying on spreadsheets and manual planners. Invest in “Agentic AI” that can make decisions, not just report data.

- See also: From Insight to Action: The Agentic Supply Chain Guide

2. Audit Your “Value Density”

UPS is shedding Amazon volume because the margin-per-package is too low.

- Action: Conduct a “Cost-to-Serve” audit. If 80% of your volume drives only 20% of your profit and requires 90% of your operational headache, you must execute your own “glide-down” and pivot to complex, high-margin verticals (Pharma, Aerospace, Luxury).

3. Build a “Control Tower” Proposition

The Singapore Blueprint succeeds because it offers visibility and trust, not just transit.

- Action: For Regional Carriers and 3PLs, the opportunity lies in becoming an Alternative Delivery Network (ADN) that offers specialized care that the giants cannot provide at scale.

- See also: Alternative Delivery Networks: Competing with Big Carriers

Future Outlook: The Great Bifurcation

We are witnessing a bifurcation of the global supply chain.

On one side, we have the “Mega-Automators” (Amazon, JD.com), who will use GenAI to drive the cost of standard e-commerce delivery to near zero, eliminating human roles in the process.

On the other side, we have the “Value Orchestrators” (UPS, Specialized 3PLs, Singapore Hubs), who will manage the complex, cross-border, high-compliance flows that require human oversight, trust, and physical security.

The middle ground is disappearing. The Singapore Supply Chain Blueprint—high-tech, high-trust, high-value—is the only viable path for logistics companies that do not own their own marketplaces. As 2026 approaches, the question for every executive is: Are you building a dumb pipe for volume, or an intelligent hub for value?