The era of relying on fragmented, manual machine shops for critical defense and aerospace components is ending. Hadrian, a software-driven manufacturing company, has secured a $1.6 billion valuation with a clear mandate: to automate the U.S. industrial base and launch factories faster than ever before.

For logistics executives and supply chain managers, this is not just a funding announcement. It is a signal flare marking the accelerating shift toward Factories-as-a-Service (FaaS) and the rapid reshoring of high-precision manufacturing.

As global instability threatens traditional supply lines, Hadrian’s rise demonstrates that the future of logistics isn’t just about moving finished goods—it’s about moving the capability to produce them closer to the point of demand.

The Facts: Hadrian’s Rise to Unicorn Status

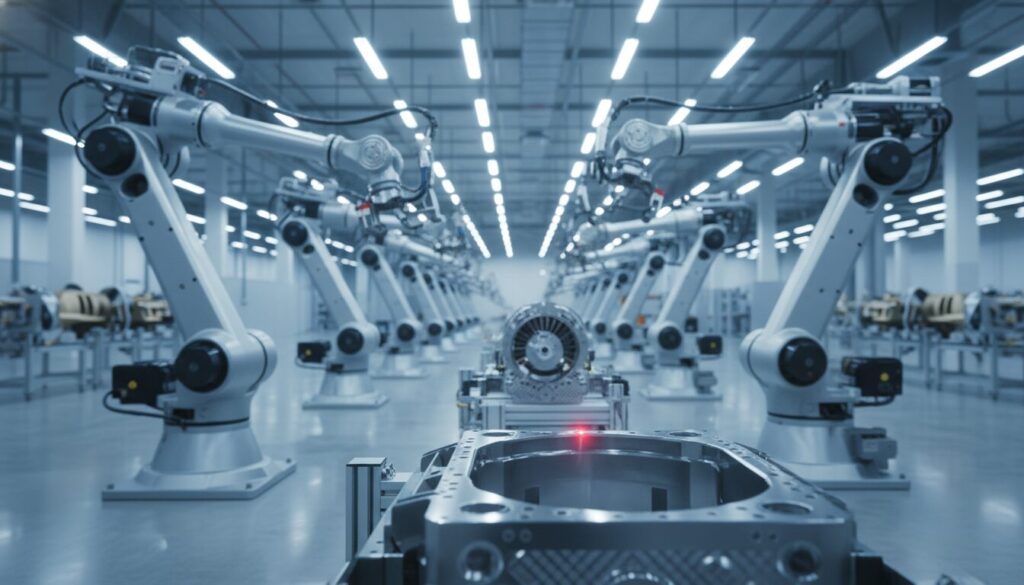

Hadrian has successfully positioned itself as the “AWS of Manufacturing,” aiming to do for industrial production what cloud computing did for server infrastructure. By replacing legacy, labor-intensive processes with a proprietary software stack, Hadrian claims it can spin up automated factories in under six months.

The company’s recent funding round, backed by heavyweights like T. Rowe Price and Andreessen Horowitz (a16z), validates the market’s appetite for sovereign industrial capacity.

Key Developments at a Glance

| Category | Details |

|---|---|

| Valuation | Reached $1.6 Billion following recent funding. |

| Core Technology | ‘Opus’ Software Stack: Automates the entire manufacturing workflow, reducing reliance on skilled manual labor. |

| Key Offering | Factories-as-a-Service (FaaS): Enabling rapid deployment of manufacturing facilities (under 6 months). |

| Target Sector | Aerospace & Defense: Focusing on high-precision parts (rockets, jets, satellites) critical to national security. |

| New Initiative | Hadrian Additive: A dedicated arm to scale 3D printing capacity for the U.S. defense base by 2026. |

| Strategic Goal | To reshore production and eliminate supply chain bottlenecks caused by offshore labor dependency. |

This development aligns with broader industry trends where major players are bringing production back to domestic soil to mitigate geopolitical risk. For instance, we are seeing similar moves in the automotive sector, as discussed in our analysis of the Case Study: GM Moves China-Made Buick to US Factory.

Industry Impact: The Ripple Effect on Logistics

Hadrian’s model of highly automated, rapidly deployable factories fundamentally changes the logistics equation for the aerospace and defense sectors. However, the implications extend to the broader supply chain ecosystem.

1. From Long-Haul to Regional Feeder Networks

The traditional model relies on shipping raw materials to low-cost labor countries and shipping finished parts back—a cycle that takes weeks or months. Hadrian’s localized FaaS model compresses this geography.

- Impact: Logistics providers will see a shift from trans-pacific container volumes toward high-frequency, short-haul domestic freight.

- Carrier Strategy: Carriers must adapt to “milk-run” style logistics, moving raw materials (billets of aluminum, titanium powder) to regional automated hubs rather than finished goods from overseas ports.

2. Warehousing: Inventory vs. Capacity

In a traditional setup, companies hold massive safety stocks to buffer against long lead times. Hadrian’s goal is to reduce lead times by 50-90%.

- Impact: The need for massive warehousing of finished spare parts decreases. Instead, the “inventory” becomes the digital file and the raw material.

- Integration: Warehouses may evolve into hybrid fulfillment-manufacturing centers where 3D printing or CNC machining happens on-site, similar to the flexible automation trends seen in Inbolt’s On-Arm AI: A New Era for Flexible Automation.

3. Supply Chain Resilience and Sovereignty

The defense industrial base (DIB) is currently plagued by a lack of skilled machinists and aging infrastructure. By automating this, Hadrian creates a “sovereign cloud” of manufacturing.

- Strategic Shift: This mirrors the semiconductor industry’s pivot, where resilience is prioritized over pure cost efficiency. This is a recurring theme we analyzed in Taiwan’s $250B US Chip Bet: Supply Chain Resilience.

- Risk Mitigation: Shippers can reduce exposure to tariffs, shipping lane disruptions (e.g., Red Sea crisis), and geopolitical embargoes.

LogiShift View: The “So What?” for Executives

Why does a valuation of a manufacturing company matter to a logistics director? Because Hadrian represents the software-defined supply chain.

Historically, the bottleneck in the supply chain was the physical movement of goods (ships, trucks, trains). Today, the bottleneck is often the manufacturing lead time caused by labor shortages and inefficient legacy shops. Hadrian is attacking the time component of the supply chain, not just the cost.

The Rise of the “API for Physical Goods”

Hadrian’s ‘Opus’ software creates an abstraction layer over the factory floor. Just as software engineers request server capacity via an API without knowing where the data center is, aerospace engineers will soon request part production via API without needing to vet individual machine shops.

- Prediction: We expect this model to spill over from Defense into Medical Devices and Automotive within 5 years.

- The Data Advantage: This approach requires immense data simulation to work. Companies like PepsiCo are already proving the value of simulation in logistics, as detailed in How PepsiCo Uses Digital Twins to Trial Changes: 4 Steps. Hadrian applies this same digital twin logic to the machining process itself.

The Labor Paradox

While Hadrian automates heavily, it doesn’t eliminate humans; it shifts the requirement from manual machinists to system operators. This parallels the integration of robotics in warehousing. For a guide on how this labor transition works in practice, refer to 5 Steps to Industrialize Humanoids via Siemens PoC Guide.

Strategic Takeaway: What Companies Should Do Next

The success of Hadrian suggests that speed and sovereignty are becoming the new KPIs for industrial supply chains.

Actionable Steps for Logistics Leaders:

-

Audit for Manufacturing Bottlenecks:

Identify which SKUs in your inventory have the longest lead times due to supplier capacity issues. These are prime candidates for a FaaS model. -

Re-evaluate Inventory Strategy:

If manufacturing lead times drop from 12 weeks to 2 weeks, your capital tied up in safety stock should drop proportionally. Adjust your WMS parameters accordingly. -

Invest in Digital Readiness:

To interface with modern manufacturing platforms like Hadrian, your product data (CAD, specs, BOMs) must be pristine and digitized. Supply chains running on PDFs and emails will be left behind. -

Monitor “Near-Shoring” Logistics Partners:

Build relationships with carriers who specialize in domestic, high-security, and expedited freight. As production comes home, the demand for these services will spike.

Bottom Line: Hadrian’s $1.6B valuation confirms that the market believes the future of manufacturing is automated, domestic, and software-defined. Logistics networks must reconfigure themselves to support this high-velocity, localized production model immediately.