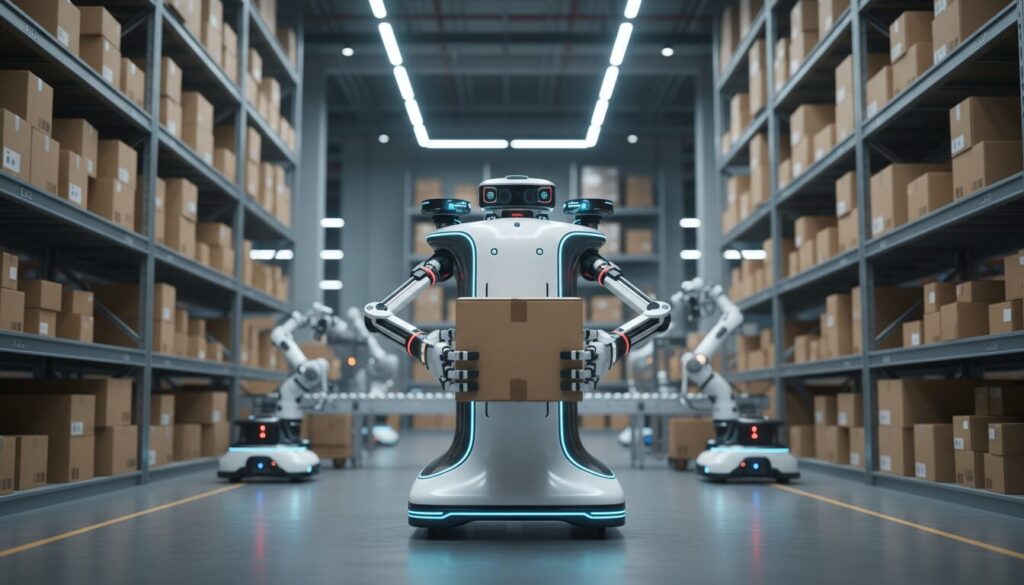

The global robotics landscape is witnessing a seismic shift. For the past decade, the industry focused on “specialized automation”—robots built to do one thing perfectly, such as welding a car door or moving a pallet from point A to point B. However, a new era of “Embodied Intelligence” is dawning, driven by leaders who have already conquered the sensor market.

In a move that has sent ripples through Silicon Valley and Shenzhen alike, the three co-founders of Hesai Technology—the global leader in LiDAR sensors for autonomous vehicles—have stepped down to launch a new venture: Sharpa.

This article analyzes why three executives of a NASDAQ-listed unicorn would pivot to general-purpose robotics, what it means for the global supply chain, and how logistics leaders should prepare for this next wave of innovation.

Why It Matters: The Pivot from “Eyes” to “Brains”

To understand the significance of Sharpa, one must understand Hesai. Hesai Technology dominates the global automotive LiDAR market, holding over 50% of the global market share for ADAS (Advanced Driver Assistance Systems) LiDAR as of 2023. They solved the “vision” problem for autonomous machines.

The launch of Sharpa by Hesai’s co-founders—Li Yifan, Sun Kai, and Xiang Shaoqing—signals a critical maturity point in the technology stack. It suggests that the hardware challenge (seeing the world) is largely solved, and the value chain is shifting toward the software challenge (understanding and acting on the world).

For logistics strategy executives, this is a major indicator. When the suppliers of the “eyes” decide to build the whole “body and brain,” it implies that general-purpose humanoids and mobile manipulators are moving from R&D labs to commercial viability.

The Logistics Labor Crisis Context

This pivot comes at a time of desperate need. The logistics sector in the US and Europe is facing a chronic labor shortage.

- USA: The Bureau of Labor Statistics projects a gap of 2.1 million manufacturing and logistics jobs by 2030.

- Europe: Germany alone faces a shortfall of nearly 400,000 skilled workers annually.

As noted in our recent analysis, autonomy is becoming non-negotiable.

See also: IFR Names Top 5 Global Robotics Trends of 2026 for Logistics

Global Trend: The Race for Embodied Intelligence

Sharpa is not entering a vacuum. They are joining a high-stakes global race involving the US, China, and Europe. The trend is moving away from static automation toward Embodied AI—robots that can learn, adapt, and perform multiple tasks in unstructured environments.

The Three-Region Power Struggle

Different regions are tackling general-purpose robotics with distinct strategies.

| Feature | United States | China | Europe |

|---|---|---|---|

| Primary Focus | End-to-End AI Models. Focus on the “Brain” (LLMs, VLA models). | Scalable Hardware & Integration. Focus on supply chain speed and cost reduction. | Industrial Application & Safety. Focus on robust deployment in existing factories. |

| Key Players | Tesla (Optimus), Figure AI, Boston Dynamics. | Sharpa, Unitree, Agibot, Fourier Intelligence. | 1X, Schaeffler, Agility Robotics (EU Operations). |

| Logistics Strategy | Replacing human labor in unstructured tasks (trailer unloading). | Mass production of affordable robots for warehousing. | Collaborative robots working alongside humans safely. |

| Investment Driver | Venture Capital & Big Tech (Microsoft, Nvidia, OpenAI). | Government Policy (New Productive Forces) & Tech Giants. | Industrial Conglomerates (BMW, Mercedes, Schaeffler). |

The “China Speed” Factor

Sharpa represents the “China Speed” methodology applied to general robotics. While US companies like Figure AI are heavily focused on the AI models (partnering with OpenAI), Chinese firms are leveraging their dominance in hardware supply chains (batteries, motors, sensors) to iterate physical prototypes faster.

The emergence of companies like 1X in Europe highlights a middle ground—using advanced “World Models” to train robots safely before deployment.

See also: 1X World Model: Critical Shift for Logistics AI

Case Study: Sharpa’s Strategic Entry

Company: Sharpa

Founders: Li Yifan (former CEO of Hesai), Sun Kai (former Chief Scientist), Xiang Shaoqing (former CTO).

HQ: likely Dual-base (Shanghai/Global).

Core Focus: General-purpose robotics with Embodied AI.

1. The “Why Now?” Strategy

Li Yifan and his team guided Hesai to a successful IPO on NASDAQ. Leaving such a position is rare. Their rationale, derived from industry statements, is that the Autonomous Driving market is entering a plateau of incremental gains, while Robotics is at the beginning of an exponential curve (the “iPhone moment”).

They possess a unique advantage: 3D Spatial Understanding.

LiDAR is fundamentally about mapping 3D space. Most general-purpose robots fail because they cannot accurately navigate complex, changing environments (like a busy cross-docking facility). Sharpa is expected to leverage the founders’ deep expertise in SLAM (Simultaneous Localization and Mapping) to build robots that move more fluidly than competitors.

2. Integration Over Components

Hesai was a component supplier. Sharpa is a systems integrator.

In logistics, the frustration has long been “islands of automation.” You have a picking arm from Vendor A, an AMR from Vendor B, and a WMS from Vendor C. Sharpa aims to build a general-purpose platform where the hardware and the AI “brain” are vertically integrated.

- Hypothesis: By controlling the sensors (their heritage), the actuators, and the AI, they can reduce latency. A robot that sees and moves in real-time is essential for fluid motion.

See also: The hidden technology behind fluid robot motion: 2025 Guide

3. Addressing the Data Deficit

The biggest hurdle for general-purpose robots is training data. Unlike ChatGPT, which was trained on the internet, robots need physical motion data. Sharpa is likely to adopt a strategy similar to automotive fleets: deploying robots to collect data, which then trains the model to be smarter.

This mirrors the approach of companies like Noitom, which are acting as “data engines” for the industry. Sharpa will likely build proprietary datasets of logistics movements—picking, packing, lifting—to train their Embodied AI.

See also: Noitom Robotics: The Data Engine for Logistics Humanoids

Key Takeaways for Logistics Leaders

The launch of Sharpa is not just tech news; it is a strategic signal for supply chain executives.

1. Expect Rapid Commoditization of Hardware

With heavyweights like Hesai’s founders entering the ring, the cost of high-end robotic hardware will drop. Just as Hesai helped drive LiDAR costs from $10,000 to $500, Sharpa will likely drive general-purpose robot costs down to the $20,000 – $30,000 range within 3-5 years.

- Action: Delay locking into 10-year rigid automation contracts. Leave room in your CAPEX budget for flexible, general-purpose fleets starting in 2026.

2. The Rise of “Brownfield” Automation

Specialized robots often require “Greenfield” sites (brand new warehouses designed for robots). General-purpose robots, the goal of Sharpa, are designed for “Brownfield” sites—existing warehouses with messy aisles, human workers, and uneven floors.

- Action: Evaluate your current facilities. If you have older infrastructure, general-purpose humanoids (or advanced bipeds) may soon be a viable alternative to rebuilding your warehouse.

3. Supply Chain Resilience via Versatility

A sorting machine can only sort. A general-purpose robot can sort in the morning, unload trucks in the afternoon, and clean aisles at night. This versatility provides resilience against seasonal peaks.

- Action: Shift metrics from “Speed per Hour” to “Tasks per Asset.” A slower robot that does 5 different jobs may offer better ROI than a fast robot that does only one.

Companies like Schaeffler are already deploying humanoids to test this versatility in real-world manufacturing settings.

See also: Schaeffler Deploys Hundreds of Humanoids: Innovation Case

Future Outlook

The entry of Hesai’s founders into the robotics space marks the beginning of the “Integrator Era.”

Short Term (2025-2026)

- Sharpa will likely announce a prototype focused on industrial/logistics scenarios (high payload, robust navigation) rather than consumer home use.

- We will see a “talent war” as automotive engineers migrate to robotics startups.

Mid Term (2027-2028)

- The boundary between Autonomous Driving tech and Robotics tech will vanish. The same AI architectures (Transformers, World Models) will drive both trucks and the robots that unload them.

- Global competition will intensify. US AI superiority vs. Chinese Hardware scalability.

Long Term (2030+)

- General-purpose robots will become a commodity service, likely offered via RaaS (Robots-as-a-Service) models. Logistics networks will be hybrid environments where human intelligence manages edge cases, while Embodied AI handles the physical flow of goods.

Conclusion:

Sharpa is a name to watch. When the people who taught cars to see decide to teach robots to think, the logistics industry must pay attention. We are moving from the age of automation to the age of autonomy.