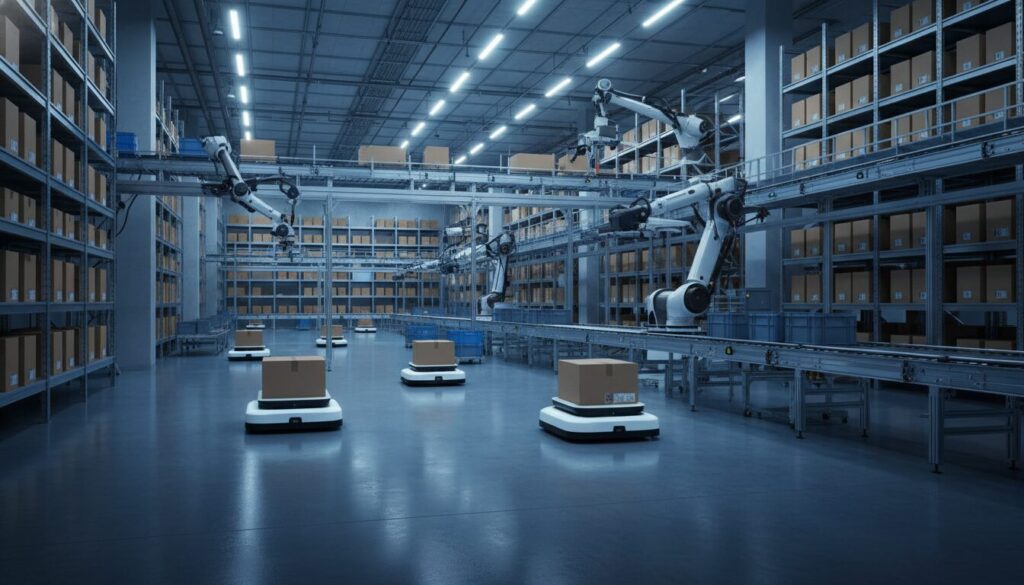

The robotics landscape has officially crossed the threshold from experimental novelty to structural necessity. According to the latest data released by the International Federation of Robotics (IFR), the global market for industrial robot installations has hit an all-time record value of $16.7 billion.

For logistics leaders and supply chain strategists, 2026 is not just another year of incremental growth; it is the year of autonomy. The IFR’s report identifies a fundamental shift driven by “Agentic AI”—artificial intelligence that doesn’t just analyze or generate text, but takes independent action in the physical world.

As we navigate structural volatility in global markets—a topic we explored in our analysis of 5 Supply Chain Management Trends 2026: New Strategy—the convergence of IT (Information Technology) and OT (Operational Technology) is creating a nervous system for the modern warehouse. This article breaks down the IFR’s top 5 trends and analyzes what they mean for global logistics strategies in the US, Europe, and Asia.

Why It Matters: The End of the “Labor Gap” Debate

For the past decade, the logistics industry debated whether robots would replace human workers. In 2026, that debate is obsolete. The global labor shortage is no longer a temporary fluctuation; it is a demographic reality in major economies like Japan, Germany, and the United States.

The IFR report underscores that automation is now the primary lever for Supply Chain Resilience. The $16.7 billion investment figure represents a desperate rush by manufacturers and logistics providers to decouple productivity from labor availability.

However, the nature of this automation is changing. We are moving away from “caged” robots that perform repetitive tasks in isolation, toward “social” robots (humanoids and AMRs) that navigate unstructured brownfield environments alongside humans. This shift requires a completely new strategic approach to infrastructure, data, and safety.

Global Trend: Regional Robotics Strategies

While the IFR trends are global, the execution varies drastically across the three major industrial powerhouses: China, the United States, and the European Union.

The Tri-Polar Robotics World

To understand where your organization fits, consider how the three major regions are adopting these technologies:

| Feature | China (The Volume Engine) | United States (The AI Brain) | Europe (The System Integrator) |

|---|---|---|---|

| Primary Focus | Mass production scalability & hardware dominance. | Software-defined robotics, Agentic AI, and Venture Capital-backed innovation. | Industrial IoT, IT/OT convergence, and safety standards (ISO). |

| Key Growth Sector | EV Manufacturing, Electronics, Basic Logistics. | E-commerce Fulfillment, Last-Mile Delivery, Healthcare. | Automotive, Precision Manufacturing, Pharma Logistics. |

| 2026 Strategy | “Robots for All”: Lowering unit costs to dominate export markets. | “Robots that Think”: Integrating LLMs and Agentic AI for complex decision-making. | “Robots that Collaborate”: Focus on cobots and human-centric automation. |

| Dominant Player Type | State-backed heavy industry giants. | Silicon Valley startups (e.g., Agility, Figure) & Big Tech (Amazon). | Heritage engineering firms (e.g., Siemens, ABB) partnering with AI firms. |

Regional Analysis:

- China continues to lead in sheer volume, installing more than half of the world’s industrial robots.

- The US is driving the software revolution, particularly in Agentic AI, transforming robots from pre-programmed machines into autonomous agents.

- Europe is setting the regulatory and integration standards, particularly regarding safety and data privacy in industrial settings.

Deep Dive: The IFR’s Top 5 Trends for 2026

The IFR has identified five specific trends that are reshaping the industry this year. Here is how they apply specifically to logistics and supply chain management.

1. Artificial Intelligence and Machine Learning (Agentic AI)

The buzzword of 2025 was “Generative AI.” The reality of 2026 is Agentic AI.

Unlike generative models that create text or images, Agentic AI combines generative capabilities with analytical AI to enable robots to sense, perceive, and act independently. In a logistics context, this means a robot does not need to be programmed with the exact coordinates of a pallet. Instead, it “looks” at a chaotic loading dock, identifies a toppled box, decides the best way to pick it up, and executes the move.

This shift reduces programming time significantly and allows robots to handle high-mix, low-volume tasks.

- See also: For a deeper look at how AI models are learning to “see” and “act,” read 1X World Model: Critical Shift for Logistics AI.

2. Expansion into New Sectors (The Rise of Humanoids)

2026 is the year humanoids move from YouTube demos to warehouse floors. The IFR highlights that technological advancements in bipedal locomotion and dexterity allow robots to work in environments designed for humans—climbing stairs, opening doors, and reaching high shelves.

This is critical for “brownfield” logistics sites (older warehouses) where retrofitting traditional automation (conveyors, ASRS) is too expensive or structurally impossible. Humanoids offer a “drop-in” solution.

- See also: Major industrial players are already moving. Read about how Schaeffler Deploys Hundreds of Humanoids: Innovation Case.

- See also: The data powering these movements is crucial. Learn more in Noitom Robotics: The Data Engine for Logistics Humanoids.

3. Convergence of IT and OT

The wall between the corporate IT network (ERP, WMS) and the Operational Technology (PLC, Robot Controllers) is crumbling. In 2026, successful robotics deployments depend on seamless data flow.

Robots are no longer isolated islands; they are edge devices in a cloud architecture. This convergence allows for real-time fleet management, predictive maintenance, and the ability for a WMS to dynamically reroute robots based on incoming order priority without human intervention.

- See also: This connectivity is vital for smart applications. Check out our analysis on UR, Robotiq & Siemens: The AI Shift in Smart Palletizing.

4. Digital Twins and Simulation

Before a physical robot is ever unboxed, it has likely already worked thousands of hours in a virtual environment. The IFR notes that “Sim-to-Real” is becoming the standard deployment method.

By creating a Digital Twin of a warehouse, logistics managers can simulate peak season loads, test different robot fleet sizes, and optimize charging schedules virtually. This de-risks the multi-million dollar investment and accelerates the time-to-value once the physical robots arrive.

5. Cybersecurity and Safety Standards

With robots connected to the cloud (Trend 3) and making autonomous decisions (Trend 1), they become potential entry points for cyberattacks. The IFR emphasizes that 2026 will see a surge in demand for cybersecurity protocols specifically for robotics (compliance with IEC 62443 and the EU Cyber Resilience Act).

Furthermore, as humanoids work closely with people, safety standards (ISO) are being rewritten to account for AI behavior that isn’t strictly deterministic.

Case Study: GXO Logistics & Agility Robotics

To illustrate these trends in action, we look at GXO Logistics, the world’s largest pure-play contract logistics provider, and their deployment of Agility Robotics’ humanoid robot, Digit.

The Challenge

GXO operates hundreds of warehouses globally. Many of these facilities handle high-volume apparel returns—a process that is notoriously difficult to automate due to the variability of package sizes, shapes, and the need for delicate handling. Traditional robotic arms require structured inputs, which returns processing rarely offers.

The Solution: “Digit” as a RaaS (Robot as a Service)

GXO deployed Digit, a bipedal humanoid designed for logistics. Unlike wheeled AMRs, Digit can reach into deep totes and place items onto conveyors at varying heights.

- Agentic AI Integration: Digit utilizes advanced computer vision to identify totes and obstacles. It doesn’t follow magnetic tape; it navigates the facility autonomously.

- IT/OT Convergence: GXO integrated Digit into its proprietary software platform, allowing the robot to communicate directly with the warehouse workflow system.

The Outcome

In 2026, GXO announced a significant scaling of this program (following successful pilots in 2024-2025). The deployment demonstrated:

- Flexibility: The robots could be moved to different aisles based on shift volume, something fixed automation cannot do.

- Labor Augmentation: The robots handled the “heavy lifting” of moving totes (weighing up to 35 lbs), reducing strain and injury rates among human workers.

- Scalability: By using a RaaS model, GXO shifted CapEx to OpEx, allowing them to scale the fleet up during peak seasons.

This case perfectly exemplifies the IFR’s trends: Humanoids utilizing Agentic AI, integrated via IT/OT convergence, to solve a labor shortage problem.

Key Takeaways for Logistics Leaders

Based on the IFR report and current market dynamics, here are the strategic imperatives for 2026:

1. Stop Buying Robots; Start Building Ecosystems

Do not purchase a robot based solely on its mechanical specs. Evaluate how easily it integrates with your existing WMS and ERP. The value is in the data flow, not just the physical movement. As seen in the UR, Robotiq & Siemens collaboration, the ecosystem is the product.

2. Prepare for the “Data Factory”

If you plan to deploy humanoids or AI-driven bots, you need clean data. Your facility must be mapped, your inventory data must be accurate, and your network bandwidth must be sufficient to handle the telemetry data from hundreds of “eyes” (cameras) moving around your floor.

3. Rethink Safety Culture

Safety is no longer just about yellow lines on the floor. It is about cybersecurity. Ensure your vendor complies with the latest ISO standards and the EU Cyber Resilience Act. A hacked robot fleet is a massive operational risk.

4. Pilot “Agentic” Capabilities Now

Move beyond simple A-to-B transport robots. Look for pilot opportunities where robots must make decisions (e.g., smart picking, palletizing mixed loads). The learning curve for Agentic AI is steep; starting now provides a competitive advantage.

Future Outlook: Beyond 2026

The IFR’s report suggests that 2026 is a pivotal year, but the trajectory points toward the “Symbiotic Warehouse” by 2030.

We are moving toward a future where:

- Heterogeneous Fleets: Humanoids, AMRs, and Drones will coordinate via a centralized AI “conductor.”

- Lights-Out Pockets: Specific zones within warehouses will become fully autonomous, while others remain human-centric for high-value, complex tasks.

- Commoditized Hardware: As seen with the entry of massive Chinese manufacturing capacity, robot hardware costs will plummet. The differentiator will be the AI software—the “brain” of the operation.

The $16.7 billion record is just the beginning. For global logistics, the question is no longer if you will adopt these technologies, but how fast you can integrate them to survive the coming years of labor scarcity and supply chain volatility.