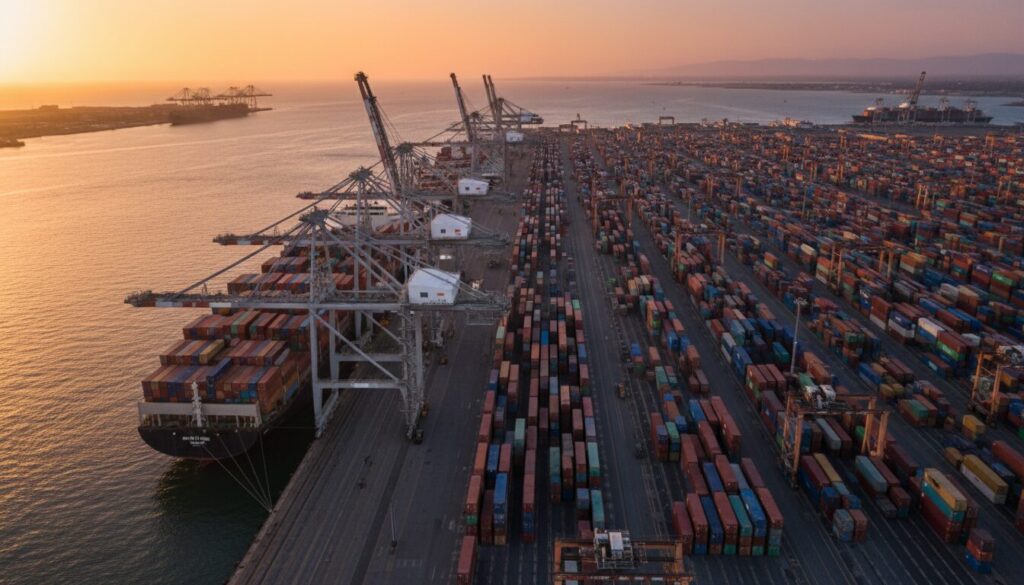

The global logistics landscape has officially entered an era defined not by temporary disruption, but by “permanent uncertainty.” Nowhere is this shift more visible than at the Port of Long Beach. In 2025, the port shattered records by processing 9.9 million twenty-foot equivalent units (TEUs), a figure driven largely by shippers frontloading cargo to bypass new aggressive tariff regimes.

However, volume is vanity; velocity is sanity. For innovation leaders and strategy executives, the headline isn’t just the volume—it is how the port managed it without collapsing, and how it is pivoting for a projected 9 million TEUs in 2026.

As discussed in Supply Chain Chaos Meets Its Match in 2026: Expert Guide, the industry is moving from reactive crisis management to proactive structural resilience. This article explores the Port of Long Beach as a definitive case study in utilizing Digital Transformation (DX) and infrastructure agility to navigate the new normal of global trade.

Why It Matters: The Era of Permanent Uncertainty

The record-breaking throughput at Long Beach in 2025 was not merely a result of organic consumer demand growth. It was a strategic, defensive reaction by global shippers. With the geopolitical landscape shifting rapidly, companies rushed to move inventory into the United States before the implementation of new trade barriers.

This phenomenon of “frontloading” created a pressure test for North American infrastructure. In previous years, such surges resulted in distinct bottlenecks—ships idling at anchor, chassis shortages, and rail dwell times stretching into weeks. In 2025, while pressure remained high, the narrative shifted toward digital visibility and infrastructure adaptation.

The Geopolitical Trigger

The driving force behind the 2025 surge was the anticipation of tariff hikes. As detailed in our analysis of how the Trump Admin Clarifies Tariff Refund Scope: Global Impact, regulatory clarity (and the lack thereof) dictates shipping windows. Shippers prioritized getting goods onto US soil over just-in-time inventory optimization, effectively trading storage costs for duty savings.

Key factors influencing this global context include:

- Tariff Evasion: Accelerating imports to beat implementation dates.

- Route Diversification: A marked shift away from reliance solely on Chinese origin points.

- Regulatory Friction: Increased scrutiny on cross-border logistics.

Global Trend: The Digital Pivot in Major Ports

While Long Beach provides the case study, the trend is global. Ports in Europe (Rotterdam, Hamburg) and Asia (Singapore, Shanghai) are engaging in an “arms race” of efficiency. The days of competing solely on berth depth and crane height are over. The new battleground is data.

We are witnessing a bifurcation in global port strategy:

- The Hardware Ports: Focus on physical expansion (dredging, new terminals).

- The Software Ports: Focus on Port Community Systems (PCS), Digital Twins, and AI-driven slot booking.

Long Beach is attempting to bridge both, but its primary success in handling the 2025 surge lies in its “Software” strategy.

Comparative Port Strategies 2025-2026

The following table illustrates how major global hubs are addressing the volume vs. velocity challenge:

| Feature | Port of Long Beach (USA) | Port of Rotterdam (EU) | Port of Singapore (Asia) |

|---|---|---|---|

| Primary 2025 Driver | Tariff Frontloading & Consumption | Energy Transition & Transshipment | Regional Hub Consolidation |

| Key Digital Tool | CargoNav (Real-time tracking) | PortCall Optimization | Digital Ocean (Just-in-Time arrival) |

| Sourcing Shift | China $\to$ Vietnam/Thailand | Asia $\to$ Nearshoring (Turkey/Africa) | Intra-Asia Growth |

| Sustainability | Zero-Emissions Terminal Plans | Hydrogen Hub Development | Green Fuel Bunkering |

For strategy executives, the lesson here is clear: Infrastructure alone cannot scale at the speed of market volatility. Digital layers must be applied to physical assets to absorb shockwaves like the 9.9M TEU surge.

See also: 5 Supply Chain Management Trends 2026: New Strategy

Case Study: Port of Long Beach’s 2025 Success

The Port of Long Beach’s performance in 2025 serves as a blueprint for resilience. Handling nearly 10 million TEUs required a fundamental rethinking of how cargo moves from ship to shore to door.

1. The Shift in Trade Partners

One of the most significant structural changes facilitating this record volume was the diversification of origin points. In 2019, China accounted for approximately 70% of imports through Long Beach. By 2025, that figure dropped to 60%.

This 10% delta was filled by the “Alt-Asia” manufacturing hubs:

- Vietnam

- Thailand

- Indonesia

This diversification reduced the risk of single-point failure (e.g., a lockdown in a specific Chinese port) but increased complexity in stowage planning and vessel scheduling, necessitating better digital tools.

2. Digital Transformation: The Launch of CargoNav

To manage the complexity of fragmented supply chains, Long Beach prepared for the 2026 launch of CargoNav. This platform represents a shift from “historical reporting” to “predictive planning.”

- What it is: A real-time inventory tracking platform accessible to BCOs (Beneficial Cargo Owners), truckers, and terminal operators.

- The Problem it Solves: “Black holes” in the terminal where containers sit available but invisible to the trucker.

- The Impact: By providing a single source of truth, the port aims to reduce dwell times and improve chassis utilization, ensuring that the 9M TEUs projected for 2026 move faster than the 9.9M TEUs of 2025.

3. The Universal Trucking Appointment System

Perhaps the most controversial yet effective innovation is the push toward a universal appointment system. Historically, individual terminals operated siloed booking systems, creating inefficiencies for drayage operators who service multiple terminals.

By unifying this system, the Port aggregates demand data, allowing for:

- Dual Transactions: Dropping off an empty and picking up a full container in a single trip.

- Gate Leveling: Spreading traffic out over 24 hours rather than peak daylight hours.

Critical Context: This efficiency drive faces headwinds from regulatory challenges. As noted in Duffy Defunds CA Over Non-Domiciled CDL Crisis, federal versus state friction regarding driver licensing and funding can threaten the labor supply required to support these digital efficiencies.

4. Infrastructure: The Pier B Rail Facility

While software optimized the flow, hardware was needed to clear the backlog. The $1.8 billion Pier B On-Dock Rail Support Facility is the port’s answer to road congestion.

- Goal: Move 35% of cargo via rail directly from the terminals.

- Capacity: The facility expands the port’s capability to handle longer trains (10,000-foot trains), reducing the need for local truck trips.

- Strategic Value: In an environment where trucking rates and labor availability are volatile, rail provides a high-volume, predictable buffer.

Key Takeaways for Logistics Leaders

The Port of Long Beach’s record year is not an anomaly; it is a stress test for the future of logistics. Here are the actionable lessons for industry leaders:

Strategic Frontloading is the New JIT

Just-in-Time (JIT) is being replaced by “Just-in-Case.” The 2025 volume spike proves that shippers are willing to pay for inventory holding costs to insure against tariff and regulatory risk. Strategy executives must build working capital models that account for these surges.

Digital Twins are Mandatory, Not Optional

The success of managing 9.9M TEUs relied on visibility. If your logistics strategy does not include API integration with port community systems or platforms like CargoNav, you are operating blind.

Diversification Requires Digital Agility

Sourcing from Vietnam and Thailand instead of just China adds complexity. As trade routes fragment, the digital thread connecting them must be stronger. Multi-sourcing strategies must be paired with multi-modal transport visibility.

Sustainability as a License to Operate

Long Beach’s commitment to a zero-emissions terminal is not just PR; it’s a prerequisite for future compliance. With California’s strict regulatory environment, only fleets and ports investing in green tech will maintain unhindered access to the market.

Future Outlook: 2026 and Beyond

As we look toward 2026, the Port of Long Beach projects a stabilization at 9 million TEUs. While slightly lower than the 2025 record, this volume represents a higher baseline than pre-pandemic levels.

The challenge for 2026 will be cost management. With the rush to beat tariffs over, shippers will return to scrutinizing rates. As highlighted in Transpacific Ocean Rates Spike to Start 2026, the volatility in ocean pricing will continue to pressure margins.

The Verdict: The “Permanent Uncertainty” of global trade requires a permanent pivot to innovation. The Port of Long Beach has demonstrated that by combining massive infrastructure investment ($1.8B rail) with agile software layers (CargoNav), it is possible to turn record-breaking disruption into record-breaking throughput. For the global logistics community, the path forward involves less concrete and more code.

For more insights on navigating regulatory shifts and market volatility, read our related analysis on Trump Admin Clarifies Tariff Refund Scope: Global Impact.

」、25年調達額が1億ドル超え。物流コスト半減、170都市で2000台稼働_hero-300x171.jpg)