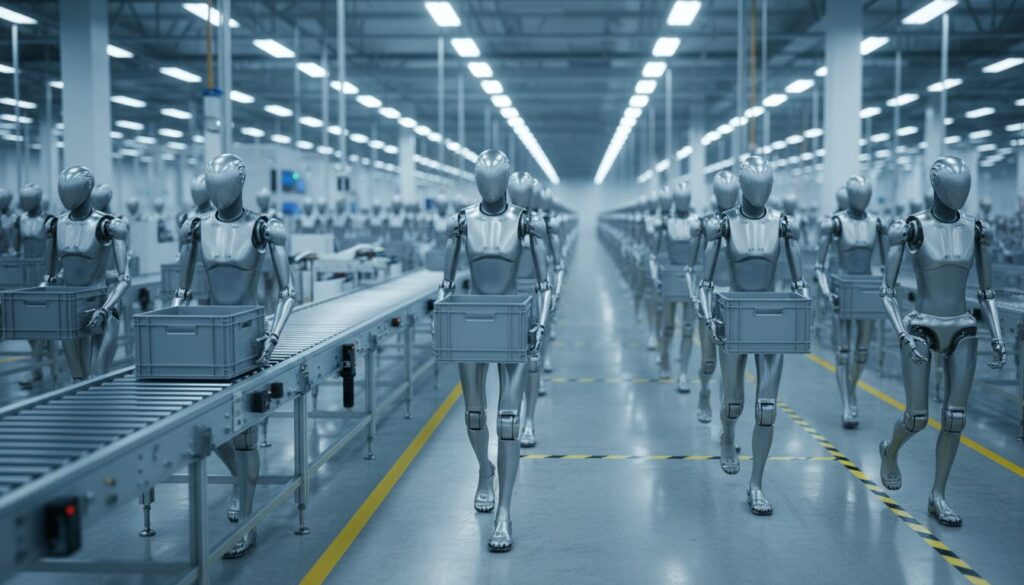

The industrial landscape is witnessing a pivot point that will define the next decade of supply chain and manufacturing operations. For years, the promise of humanoid robotics was relegated to R&D labs and viral videos of parkour-performing machines. Today, that narrative has shifted abruptly toward scalable industrial application.

The recent strategic alliance between German motion technology giant Schaeffler and Humanoid (SKL Robotics) to deploy hundreds of robots represents a maturation of the market. This is no longer just about testing if a robot can walk; it is about proving a robot can work alongside humans in brownfield facilities at scale.

For innovation leaders and strategy executives in the US, Europe, and Asia, this move signals the transition from “Pilot Purgatory” to genuine industrial integration. As discussed in our analysis of Boston Dynamics’ Atlas Pilot: The Humanoid Logistics Shift, the logistics sector is moving rapidly from curiosity to commercial necessity.

Why It Matters: The Convergence of Hardware and AI

The global supply chain is facing a trifecta of pressures: a chronic labor shortage, a demand for hyper-flexibility, and the need for supply chain resilience. Traditional automation (caged arms, conveyor belts) is efficient but rigid. It requires structured environments.

Humanoid robots promise the “Holy Grail” of automation: General Purpose Utility. They can operate in environments built for humans—climbing stairs, navigating narrow aisles, and handling unstructured objects—without requiring a facility redesign.

Schaeffler’s entry is particularly significant because they are not just a customer; they are a key supplier. By integrating their high-precision planetary gear actuators into the robots they deploy, they are closing the loop between component manufacturing and end-user application. This “dogfooding” strategy—using one’s own products to validate quality—adds a layer of credibility often missing in pure software-driven robotics startups.

Global Trend: The Race for Generalist Labor

While Schaeffler represents a European industrial stronghold, the context of this deployment must be viewed through a global lens. The race to deploy humanoid labor is intensifying across three major geopolitical axes: the US, China, and Europe.

The United States: AI-First Approach

In the US, the focus is heavily heavily tilted toward the “brain” of the robot. Companies like Tesla (Optimus) and Figure AI are leveraging massive foundation models to teach robots to generalize tasks.

- Strategy: Speed to market via software scalability.

- Key Enabler: Physical AI. See our report on Nvidia’s ‘Android’ Strategy: The Age of Generalist Robotics to understand how US tech giants are building the operating systems for these machines.

China: Hardware Velocity

Chinese manufacturers like Fourier Intelligence and Unitree are driving down the cost of hardware through rapid iteration and supply chain dominance.

- Strategy: Cost leadership and mass production.

- Key Enabler: Component commoditization.

Europe: Industrial Precision

Europe, exemplified by the Schaeffler case, is focusing on reliability, safety, and integration into complex manufacturing ecosystems (Industry 4.0).

- Strategy: High-precision mechanics and collaborative safety.

- Key Enabler: Advanced actuators and brownfield integration.

Comparative Analysis: Global Humanoid Strategies

| Region | Primary Focus | Key Players | Strategic Goal |

|---|---|---|---|

| Europe (EU) | Precision & Integration | Schaeffler (SKL), Sanctuary AI (Partnerships) | Deep integration into existing industrial workflows with high reliability. |

| United States | AI & Generalization | Tesla, Agility Robotics, Figure AI | creating a “brain” that can learn any task; rapid software scaling. |

| China | Cost & Hardware Speed | Unitree, Fourier Intelligence | Mass production of affordable hardware platforms to flood the market. |

Case Study: Schaeffler and Humanoid (SKL Robotics)

The partnership between Schaeffler and Humanoid (SKL Robotics) serves as a blueprint for how legacy industrial companies can leapfrog into the age of embodied AI.

The Strategic Alliance

Schaeffler has secured a strategic partnership with Humanoid (SKL Robotics), a deep-tech company specializing in embodied AI. The agreement is twofold:

- Deployment: Schaeffler will deploy hundreds of humanoid robots across its global plant network by 2026–2027.

- Supplier Status: Schaeffler becomes the preferred supplier for the robot’s primary joints, providing specialized planetary gear actuators.

The Technology: Speed and Precision

The development speed of the HMND 01 platform has been startling.

- Prototype Speed: From concept to functional prototype in just 7 months.

- Learning Curve: The robot achieved stable bipedal locomotion within 48 hours of reinforcement learning training.

This velocity is made possible by the “Data Engine” concept, similar to what we observed in Noitom Robotics: The Data Engine for Logistics Humanoids, where simulation and motion capture accelerate real-world learning.

The Hardware Advantage: Planetary Gear Systems

Unlike hydraulic systems (often used by Boston Dynamics historically) or harmonic drives, Schaeffler is utilizing compact, high-efficiency planetary gear systems.

Why this matters for logistics:

- Durability: Industrial environments are harsh. Planetary gears offer higher torque density and shock resistance compared to strain-wave gears.

- Energy Efficiency: For a battery-operated humanoid, actuator efficiency defines shift length. Schaeffler’s expertise ensures the robot can work longer intervals between charges.

Commercial Flexibility: RaaS and CapEx

To facilitate the deployment of hundreds of units, the partnership utilizes a hybrid commercial model:

- Robot-as-a-Service (RaaS): Allows factories to treat robots as an operating expense (OpEx) rather than a capital expense, reducing the risk of adoption.

- CapEx Models: Available for facilities requiring total asset ownership.

Key Takeaways for Logistics Leaders

For strategy executives observing this trend, the Schaeffler case offers critical lessons on how to approach the next wave of automation.

1. The Shift from “Specialist” to “Generalist”

Traditional automation (like the systems discussed in UR, Robotiq & Siemens: The AI Shift in Smart Palletizing) is excellent for repetitive, high-speed tasks. However, Schaeffler’s move targets the gaps between these systems—moving parts between cells, quality checks, and maintenance support.

Actionable Insight: Audit your facility for tasks that are high-mix, low-volume, and require mobility. These are your humanoid pilot zones.

2. Brownfield is the Battlefield

Schaeffler is not building new “robot-only” factories for these machines. They are deploying them into existing plants.

Actionable Insight: Invest in robots that can navigate your current floor plan. If the robot requires you to bolt down new infrastructure, it loses its primary value proposition against an AMR (Autonomous Mobile Robot).

3. Supply Chain Resilience via “Dogfooding”

Schaeffler is reducing its own supply chain risk by manufacturing the critical components (actuators) for the robots it uses.

Actionable Insight: If your company manufactures components relevant to robotics (sensors, batteries, casings), explore partnerships where you can be both a supplier and a user. It creates a symbiotic feedback loop that accelerates R&D.

4. Speed of Deployment is Increasing

The 7-month prototype timeline for the HMND 01 suggests that the hardware cycle is shortening.

Actionable Insight: Do not plan for 5-year ROI cycles on specific hardware models. Adopt RaaS models to maintain the flexibility to upgrade as hardware iterates rapidly.

Future Outlook: The 2026-2030 Horizon

The Schaeffler and Humanoid (SKL Robotics) partnership effectively sets a timeline for the industry. With beta-stage integration slated for 2026–2027, we are looking at a 24-month window before humanoids become a common sight in Tier 1 manufacturing facilities.

What to Watch

- Standardization of Actuators: Will Schaeffler’s planetary gear design become the industry standard for humanoids, displacing harmonic drives?

- Safety Standards: As hundreds of robots enter shared workspaces, EU safety regulations (ISO/TS 15066 evolution) will be tested and likely rewritten.

- The Data Feedback Loop: As these robots begin working, the data they collect will be fed back into training models, creating a flywheel effect where robots get smarter exponentially faster.

The era of the humanoid is no longer science fiction. It is a procurement strategy. For logistics and manufacturing leaders, the question is no longer “if” but “how soon” to integrate these general-purpose assets into the workforce. Schaeffler has made its move; the rest of the market must now decide whether to follow or be left with yesterday’s automation.