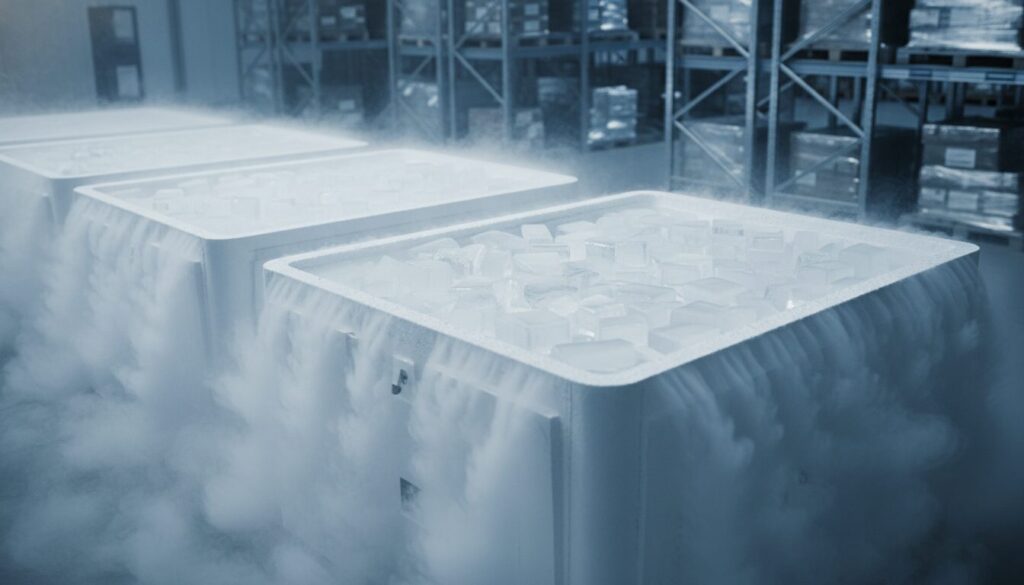

The global logistics sector is currently facing a silent crisis that threatens to disrupt the delicate ecosystem of temperature-controlled supply chains. For decades, solid carbon dioxide—colloquially known as dry ice—has served as the unsung hero of the cool chain, facilitating the transport of everything from frozen perishables to life-saving mRNA vaccines. However, a “warning as production of dry ice for cool chains is on a slow melt” has been issued by industry analysts, signaling a structural shift rather than a temporary blip.

As we look toward next year, the convergence of geopolitical energy instability, decarbonization efforts, and supply chain bottlenecks creates a projected structural shortage of this critical commodity. For innovation leaders and strategy executives, the question is no longer about how to source more dry ice, but how to redesign supply chains to survive without it.

Why It Matters: The “By-Product Trap”

To understand the gravity of the dry ice shortage, one must understand its origin. CO2 is rarely produced for its own sake; it is primarily a by-product of industrial ammonia production (used for fertilizer) and bio-ethanol manufacturing.

The Energy-Fertilizer Nexus

The production of ammonia relies heavily on natural gas. When natural gas prices spike—as seen during the energy crisis in Europe triggered by the Ukraine conflict—fertilizer plants curb production or shut down entirely because operations become unprofitable. When these plants go offline, the supply of food-grade CO2 evaporates almost instantly.

This creates a dangerous “by-product trap” for logistics leaders:

1. Dependency: The cool chain is dependent on the waste product of an entirely different industry (agriculture/fertilizer).

2. Volatility: Sourcing is tied to the volatile energy markets, specifically Natural Gas (TTF in Europe, Henry Hub in US).

3. Seasonality: Fertilizer production is seasonal, often dipping in summer when cooling demand is actually highest.

The Immediate Impact on Pharma and Perishables

The stakes are highest for two sectors: Pharmaceuticals and Food Logistics.

* Pharmaceuticals: The COVID-19 pandemic normalized the transport of ultra-cold payloads (-70°C). While new formulations have relaxed some requirements, the gene therapy and biologicals market continues to grow, requiring stringent deep-frozen chains.

* Perishables: The “Direct-to-Consumer” (DTC) frozen food market exploded post-2020. Companies shipping meal kits and gourmet frozen goods rely almost exclusively on blocks of dry ice sublimating inside polystyrene or sustainable insulation boxes.

Global Trend: A Fractured CO2 Landscape

The shortage is not uniform; it is a complex patchwork of regional deficits. Innovation leaders must navigate these disparate realities.

Europe: The Epicenter of Volatility

Europe represents the most fragile market due to its historic reliance on imported natural gas.

* Production Cuts: Major players like Yara International and CF Industries have historically curtailed ammonia production at their European facilities when gas prices render operations unviable. In the UK, the government has previously had to intervene to subsidize CO2 production to prevent food supply chain collapse.

* Regulatory Pressure: The EU’s aggressive decarbonization targets mean that traditional, carbon-heavy fertilizer production is under scrutiny, further threatening the long-term supply of by-product CO2.

North America: Distribution Bottlenecks

While the United States benefits from domestic natural gas reserves, shielding it from the worst of the pricing shocks, it faces infrastructure challenges.

* Regional Disparities: The US market suffers from geographic mismatches. CO2 capture facilities are often located in the Midwest (corn belt/ethanol) or Gulf Coast (petrochemicals), while demand hotspots are coastal (biotech hubs in Boston/California).

* Supplier Consolidation: The industrial gas market is heavily consolidated (dominated by giants like Linde and Air Liquide), which can limit negotiating power for mid-sized logistics firms during shortage allocations.

Asia-Pacific: The Demand Surge

In Asia, the challenge is less about production contraction and more about demand outpacing infrastructure.

* China’s Cold Chain Boom: China’s 14th Five-Year Plan explicitly targets the expansion of cold chain logistics. As the middle class grows, demand for premium frozen foods is skyrocketing, putting immense pressure on local dry ice supplies.

* Japan’s Summer Squeeze: Japan frequently faces “dry ice crunches” during peak summer months, impacting consumer deliveries.

Comparative Analysis of Regional Risks

| Region | Primary Risk Factor | Supply Chain Maturity | Short-Term Outlook |

|---|---|---|---|

| Europe | Energy cost volatility & Fertilizer plant shutdowns | High | Critical / Structural Deficit |

| North America | Distribution distance & Trucking shortages | High | Moderate / Regional Gaps |

| Asia (China) | Demand outpacing production capacity | Rapidly Developing | High Stress / Expansion Pain |

| Asia (Japan) | Seasonal demand spikes vs. static capacity | Mature | Seasonal Shortages |

Case Study: Va-Q-tec and the Shift to Passive Efficiency

As the dry ice supply becomes unreliable, forward-thinking companies are not just looking for new suppliers; they are looking for technology that eliminates the need for dry ice replenishment. A prime example of this strategic pivot is Va-Q-tec (recently acquired by Envirotainer).

The Challenge: reducing Dry Ice Reliance

Traditional “active” containers use compressors (like a fridge) and batteries, which are heavy and expensive. Traditional “passive” containers use water-based gel packs (good for 2-8°C) or massive amounts of dry ice (for deep frozen).

The industry faced a dilemma: How to ship deep-frozen goods globally without relying on volatile dry ice availability at transit hubs?

The Solution: Phase Change Materials (PCMs)

Va-Q-tec pioneered the use of advanced Vacuum Insulation Panels (VIPs) combined with specialized Phase Change Materials (PCMs).

* Technology: Unlike water, which freezes at 0°C, PCMs are engineered salts or paraffins that freeze and melt at specific temperatures (e.g., -20°C or -60°C).

* The Innovation: By using high-performance insulation, these containers act like a thermos flask on steroids. They can maintain deep-frozen temperatures for up to 120 hours (5 days) or more without any external energy source or dry ice refill.

Operational Success

This technology allowed global pharma distributors to bypass the “re-icing” bottlenecks.

1. Eliminating Touchpoints: In a traditional dry ice shipment from Frankfurt to Tokyo, a logistics provider might need to “re-ice” the pallet at a Dubai stopover. This requires sourcing dry ice in Dubai (a desert) and opening the box (temperature excursion risk).

2. Resilience: With Va-Q-tec’s long-duration passive containers, the shipment stays closed from origin to destination. If dry ice is unavailable at the transit hub, it doesn’t matter—the PCM holds the charge.

Strategic Impact for Logistics Managers

By adopting advanced passive solutions, companies achieved:

* Risk Reduction: Decoupled logistics from the volatile CO2 commodity market.

* Sustainability: PCMs are reusable, whereas dry ice is single-use and sublimates into Greenhouse Gas (though usually recaptured, the optical perception varies).

* Total Landed Cost: While the packaging is more expensive upfront, the elimination of emergency re-icing fees and product spoilage resulted in net savings.

Key Takeaways: Lessons for the Logistics Industry

The “slow melt” of dry ice availability is a bellwether for wider supply chain resource constraints. Executives should apply the following lessons:

1. Decouple from Volatile Commodities

If your critical path depends on a by-product of the oil and gas industry, you are exposed to geopolitical risk.

* Action: Audit supply chains for hidden dependencies (e.g., AdBlue, CO2, Helium). Invest in technologies that substitute these commodities (e.g., Nitrogen cooling, PCMs).

2. Move from “Just-in-Time” to “Just-in-Case” Thermal Packaging

The era of cheap, disposable styrofoam and dry ice is ending due to both shortages and ESG pressures.

* Action: Transition to high-performance reusable packaging (Rental models like CSafe, Envirotainer, Tower Cold Chain). These containers provide a “thermal buffer” that allows shipments to survive unexpected delays without needing immediate dry ice top-ups.

3. Diversify Cooling Methods

Do not rely on a single cooling modality.

* Action: Implement a hybrid strategy. Use Active Containers (battery-powered compressors) for high-value bulk airfreight, PCMs for mid-sized lane segments, and reserve Dry Ice only for the “last mile” where retrieval of reusable packaging is impossible.

4. Data-Driven Volume Forecasting

Suppliers like Linde and Airgas prioritize customers who provide accurate forecasts.

* Action: Integrate ERP systems with gas suppliers. Moving from spot-buying to long-term contracted volume with accurate forecasting is the only way to secure allocation during a crunch.

Future Outlook: The Next Decade of Cool Chains

The structural shortage of dry ice will accelerate technological innovation in three key areas.

The Rise of “Green” CO2

We will see a shift away from fertilizer-based CO2 toward Direct Air Capture (DAC) and Biogas capture. Companies like Climeworks are pioneering technology to suck CO2 directly from the air. While currently too expensive for industrial dry ice, the cost curve will eventually come down, creating a “fossil-free” source of dry ice that appeals to ESG-conscious pharma companies.

Electrification of the Reefer

The ultimate solution to the dry ice problem is electrification. We are seeing the miniaturization of active cooling technology. Future parcel-sized shipments may carry micro-compressors and solid-state batteries, effectively becoming mini-refrigerators that require electricity, not ice.

On-Demand Production

For large logistics hubs (e.g., Memphis, Liege, Singapore), we may see the installation of on-site dry ice recovery and production units. Instead of trucking liquid CO2 in, hubs will capture waste CO2 from local industrial processes or use small-scale generation to produce dry ice pellets on-demand, reducing sublimation losses during transport.

The warning regarding dry ice production is real, but it is not a death knell for the cool chain. It is a catalyst for modernization. By shifting from commodity reliance to technological resilience, global logistics leaders can ensure that even as the ice melts, their supply chains remain frozen solid.